Wondering if you are ready to buy your first home?

Many people have either reservations or just don’t know if they are ready to buy a home now or later. Some think that they should hold off until they are married of have children while others think they are still too young for the responsibility. Aside from some having the fear of taking on a mortgage, many feel that they may not have the money to enter into homeownership. The truth is that you probably don’t need to have as much money as you think.

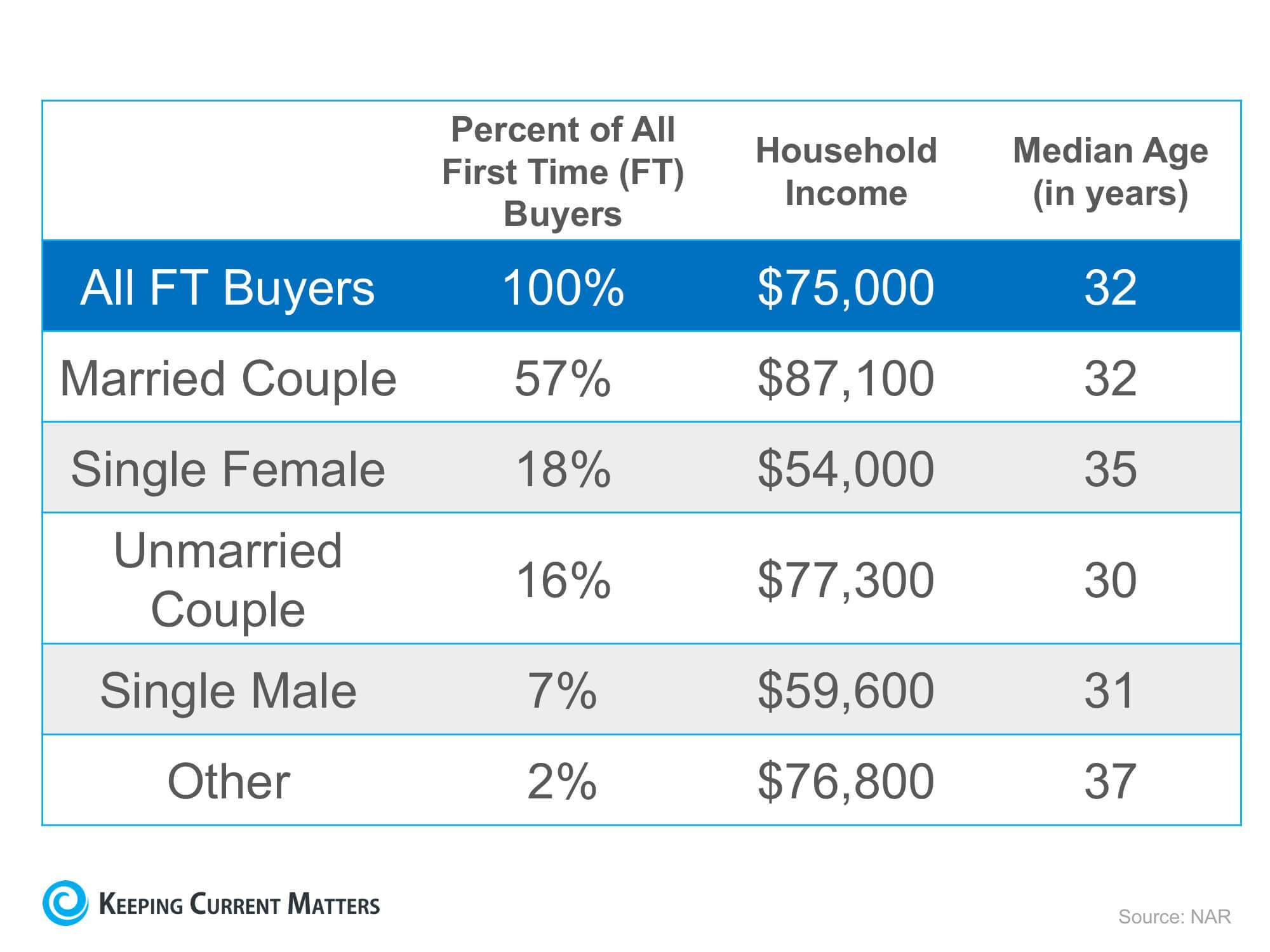

To show you the facts through trends, here is what the average first-time homebuyer looks like per a recent report from the National Association of Realtors.

The bottom line is that you may not be all that different from the profile of the Americans who have already purchased their first home.

As an experienced real estate professional, I have worked with many individuals of all types of ages and financial backgrounds and would be happy to guide you through the process. For starters, it is most important to get pre-approved by a reputable mortgage agent. This person can identify your financial standing and alert you of how much you can afford and what you will have to put down based on your income, debt and credit score. You may be shocked to see the options that exist that may not be too far off from renting in the way of potential monthly payments as well as money needed up front.

Once you have been approved then the fun begins. Based on the amount you can afford, then you can start previewing homes that fall within your budget and meet your needs. After finding the right fit, you can submit your offer and hopefully secure a purchase.

Purchasing a home sooner than later also has its advantages. As your monthly payments will be applied to your loan balance, you will begin to accrue equity over time much in the same way as like a forced savings account. The sooner you begin this process, the sooner your home will be paid off as you set yourself for a comfortable retirement.